Getting from A to B is as easy as 1 – 2 – 3

Kiwis love their cars. The ability to get from A to B on our own terms whenever we want to means that almost every household in New Zealand has at least one private motor vehicle.

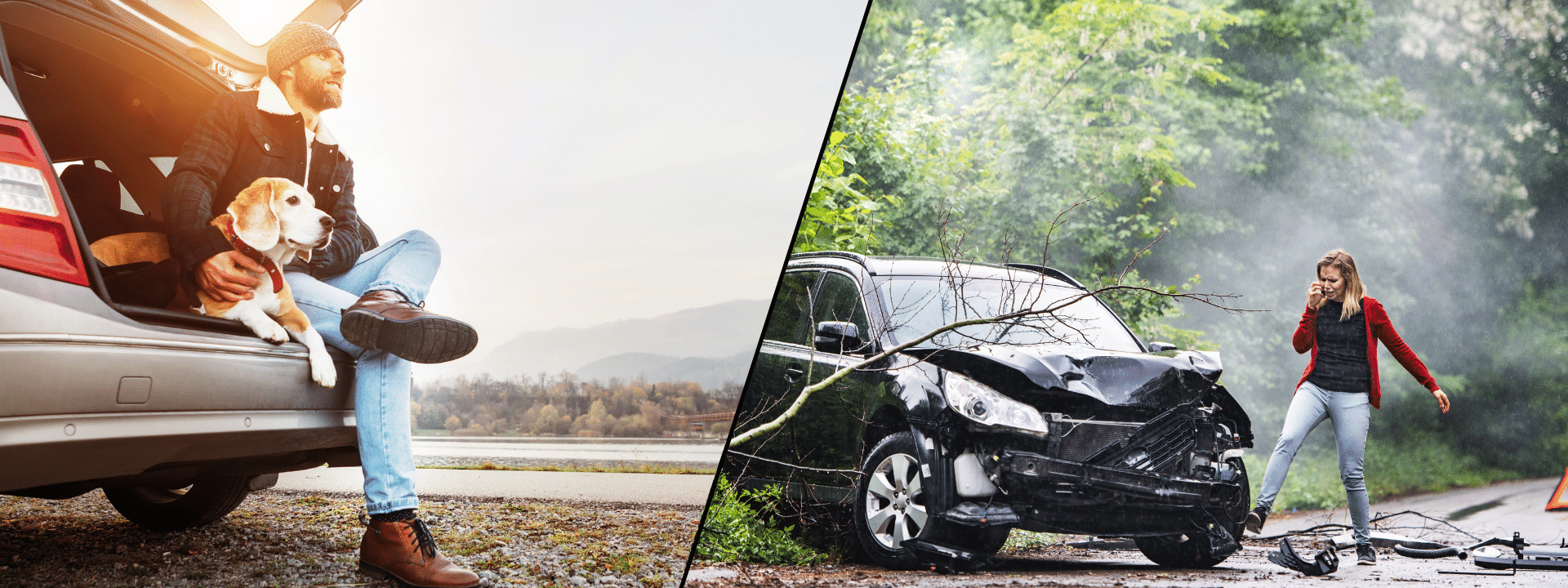

But when the unexpected happens, like a nose to tail on the motorway, someone not giving way to you at a roundabout, or swerving into a tree to avoid hitting a dog, it pays to have an insurance policy that will make sure you (and anyone else involved in your accident) are covered.

Whether you drive a private car, business vehicle, caravan, or truck, a sound motor vehicle insurance policy should be a no-brainer, both for you and for anyone you might hit. Threefold’s insurance advisers understand how to recommend the best motor vehicle insurance policy to fit your unique situation, regardless of what you use your vehicle for.

From third-party motor vehicle insurance through to full cover, Threefold will recommend an insurance provider or policy that covers the scenarios that are important to you. Our insurance advisory team has many years of experience between us which means we can foresee the kind of cover you might want to include, even if you’ve never considered it. With great relationships with all the major insurance players, we know which will work for you and which will work for someone else.

Drive a motor vehicle of some description? You need insurance. Talk to Threefold’s friendly, experienced insurance advisory team today to make sure you’re covered, just in case the unexpected happens.

We work with New Zealand's leading insurers to find the right insurance product for you

We access their most competitive rates, so you don't need to shop around.

Making a Claim

As much as we all hope it’s never necessary, when the unthinkable happens and you need to make a claim, we are here to help. Threefold’s team support you through a streamlined claim process, combining our expert knowledge of the industry with our bespoke knowledge of your policies.

Home and Contents

Home and contents insurance is one of those things that many people think they’ll never need, then wish they had when the unexpected happens. But understanding what to include in a policy that prepares for the unknown, not to mention how much you should cover, can be confusing.

Business Insurance

If you’re in business of any kind, you need insurance. It doesn’t matter how big or how small you are, what products or services you sell, or what industry you work in; it’s important to invest in business insurance so if the unthinkable happens, you’re not left out of pocket and your business can recover.

Travel Insurance

Our insurance team has many years’ experience dealing with all the major travel insurance players so when you’re looking for a policy to suit your unique travel situation, we can match you with a provider that will tick all your boxes. International or domestic, one-off or regular; our team has you covered.